The IRS’s commitment to LEP taxpayers is part of a multi-year timeline that began providing translations in 2023. You will continue to receive communications, including notices and letters, in English until they are translated to your preferred language. This tool lets your tax professional submit an authorization request to access your individual taxpayer IRS online account. Go to IRS.gov/Account to securely access information about your federal tax account. The IRS is committed to serving taxpayers with limited-English-proficiency (LEP) by offering OPI services. The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers (TACs), most IRS offices, and every VITA/TCE tax return site.

Expert does your taxes

Under this convention, you treat all property placed in service or disposed of during a month as placed in service or disposed of at the midpoint of the month. This means that a one-half month of depreciation is allowed for the month the property is placed in service or disposed can you depreciate leased equipment of. If you begin to rent a home that was your personal home before 1987, you depreciate it as residential rental property over 27.5 years. The following is a list of the nine property classifications under GDS and examples of the types of property included in each class.

Tax benefit of operating leases vs capital leases – Overview

The following are examples of some credits and deductions that reduce depreciable basis. For certain specified plants bearing fruits and nuts planted or grafted after December 31, 2023, and before January 1, 2025, you can elect to claim a 60% special depreciation allowance. Generally, the rules that apply to a partnership and its partners also apply to an S corporation and its shareholders. The deduction limits apply to an S corporation and to each shareholder. The S corporation allocates its deduction to the shareholders who then take their section 179 deduction subject to the limits.

Operating Leases vs. Capital Leases & Depreciation

The item of listed property has a 5-year recovery period under both GDS and ADS. 2023 is the third tax year of the lease, so the applicable percentage from Table A-19 is −19.8%. Larry’s deductible rent for the item of listed property for 2023 is $800. You cannot use the MACRS percentage tables to determine depreciation for a short tax year. This section discusses the rules for determining the depreciation deduction for property you place in service or dispose of in a short tax year. It also discusses the rules for determining depreciation when you have a short tax year during the recovery period (other than the year the property is placed in service or disposed of).

Property you acquire only for the production of income, such as investment property, rental property (if renting property is not your trade or business), and property that produces royalties, does not qualify. Off-the-shelf computer software is qualifying property for purposes of the section 179 deduction. This is computer software that is readily available for purchase by the general public, is subject to a nonexclusive license, and has not been substantially modified.

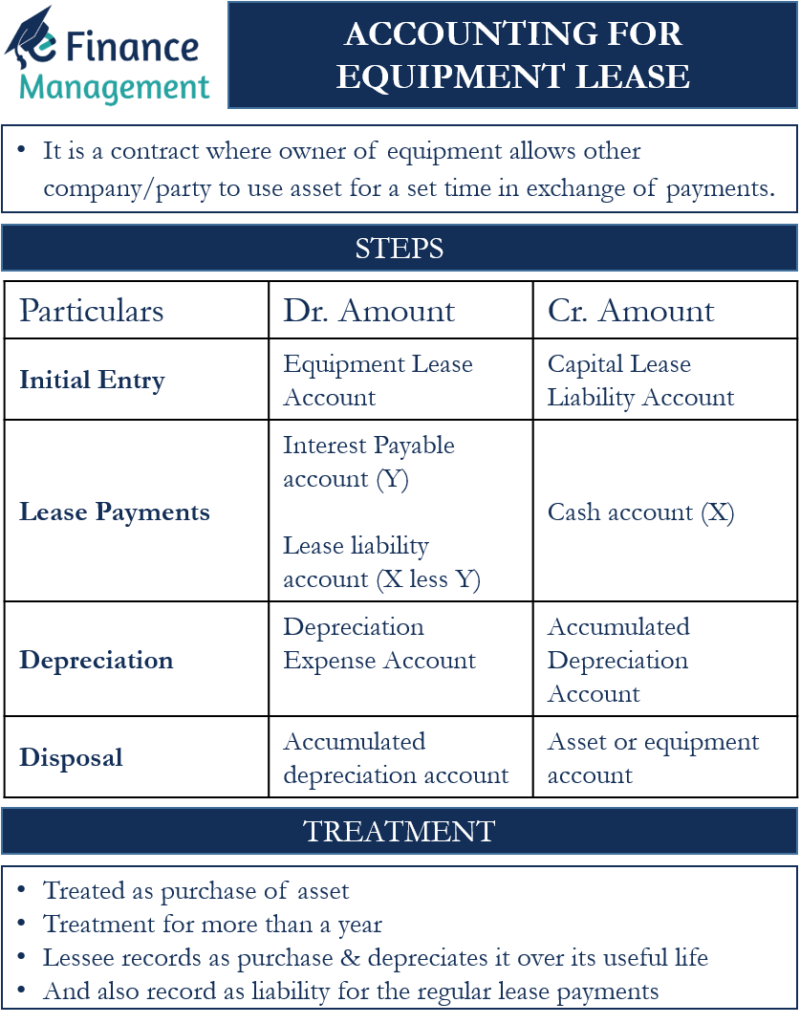

Mastering the Books: How to Account for Leased Equipment

You deduct 80% of the cost ($360,000) as a special depreciation allowance for 2023. You use the remaining cost of the property to figure a regular MACRS depreciation deduction for your property for 2023 and later years. Unless there is a big change in adjusted basis or useful life, this amount will stay the same throughout the time you depreciate the property. If, in the first year, you use the property for less than a full year, you must prorate your depreciation deduction for the number of months in use. When it comes to capital leases, the answer to “can leased equipment be depreciated” is yes. A capital lease is treated like a purchase for accounting purposes.

You can depreciate the part of the property’s basis that exceeds its carryover basis (the transferor’s adjusted basis in the property) as newly purchased MACRS property. If you file Form 3115 and change from an impermissible method to a permissible method of accounting for depreciation, you can make a section 481(a) adjustment for any unclaimed or excess amount of allowable depreciation. The adjustment is the difference between the total depreciation actually deducted for the property and the total amount allowable prior to the year of change.

- If the videocassette has a useful life of 1 year or less, you can currently deduct the cost as a business expense.

- However, most capital expenses cannot be claimed in the year of purchase, but instead must be capitalized as an asset and written off to expense incrementally over a number of years.

- March is the third month of your tax year, so multiply the building’s unadjusted basis, $100,000, by the percentages for the third month in Table A-7a.

- A depreciation rate (percentage) is determined by dividing the declining balance percentage by the recovery period for the property.

If you have a short tax year of 3 months or less, use the mid-quarter convention for all applicable property you place in service during that tax year. Tara Corporation, a calendar year taxpayer, was incorporated on March 15. For purposes of the half-year convention, it has a short tax year of 10 months, ending on December 31, 2023. During the short tax year, Tara placed property in service for which it uses the half-year convention. Tara treats this property as placed in service on the first day of the sixth month of the short tax year, or August 1, 2023. You must make the election on a timely filed return (including extensions) for the year of replacement.

You must use the applicable convention for the first tax year and you must switch to the straight line method beginning in the first year for which it will give an equal or greater deduction. For the year of the adjustment and the remaining recovery period, you must figure the depreciation deduction yourself using the property’s adjusted basis at the end of the year. Dean does not have to include section 179 partnership costs to figure any reduction in the dollar limit, so the total section 179 costs for the year are not more than $2,890,000 and the dollar limit is not reduced. However, Dean’s deduction is limited to the business taxable income of $80,000 ($50,000 from Beech Partnership, plus $35,000 from Cedar Partnership, minus $5,000 loss from Dean’s sole proprietorship). Dean carries over $45,000 ($125,000 − $80,000) of the elected section 179 costs to 2024. Dean allocates the carryover amount to the cost of section 179 property placed in service in Dean’s sole proprietorship, and notes that allocation in the books and records.

For this purpose, sound recordings are discs, tapes, or other phonorecordings resulting from the fixation of a series of sounds. You can depreciate this property using either the straight line method or the income forecast method. You can choose to use the income forecast method instead of the straight line method to depreciate the following depreciable intangibles. Computer software is generally a section 197 intangible and cannot be depreciated if you acquired it in connection with the acquisition of assets constituting a business or a substantial part of a business.